ACS provides clients with a full range of outsourcing services across a variety of receivables including:

ACS can provide all the necessary tailored combinations of systems, staff and processing - specifically designed for your needs.

Whether you are looking to outsource a specific role to complement your existing infrastructure and functional requirements or you are looking for a partner that offers total, end-to-end portfolio management - ACS can develop a solution that will meet your requirements.

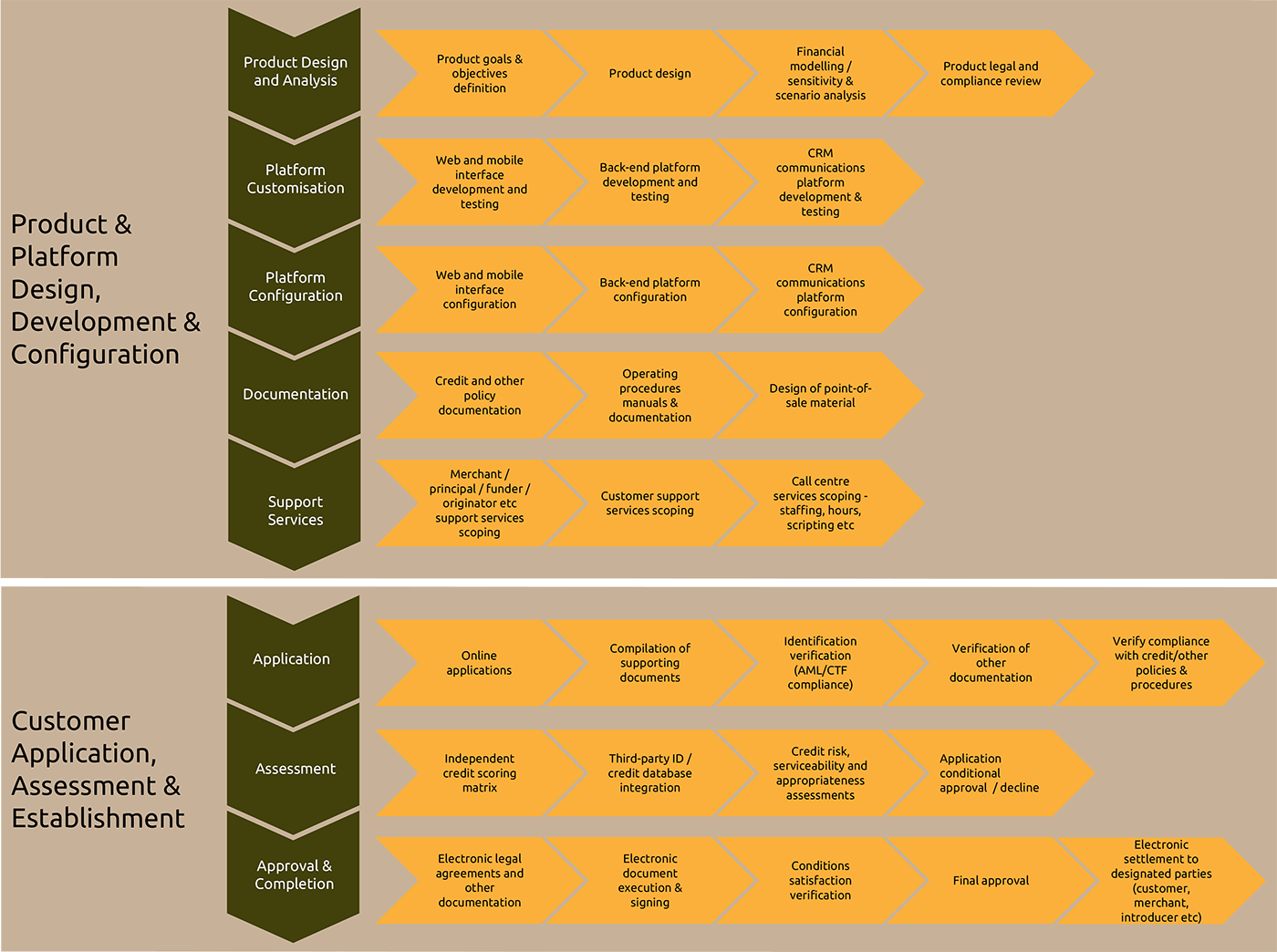

Our team has a wealth of knowledge in lending processes and systems, and can assist with the design of products and processes to achieve your commercial objectives while satisfying compliance obligations.

In addition, ACS has extensive capabilities in developing financial models to support feasibility analyses on credit and other financial products - enabling you to undertake detailed financial sensitivity and scenario analysis on your products during the design phase.

If you’re just starting out and need assistance or are looking to extend your existing service or product offering, ACS can provide additional advisory services including introductions to:

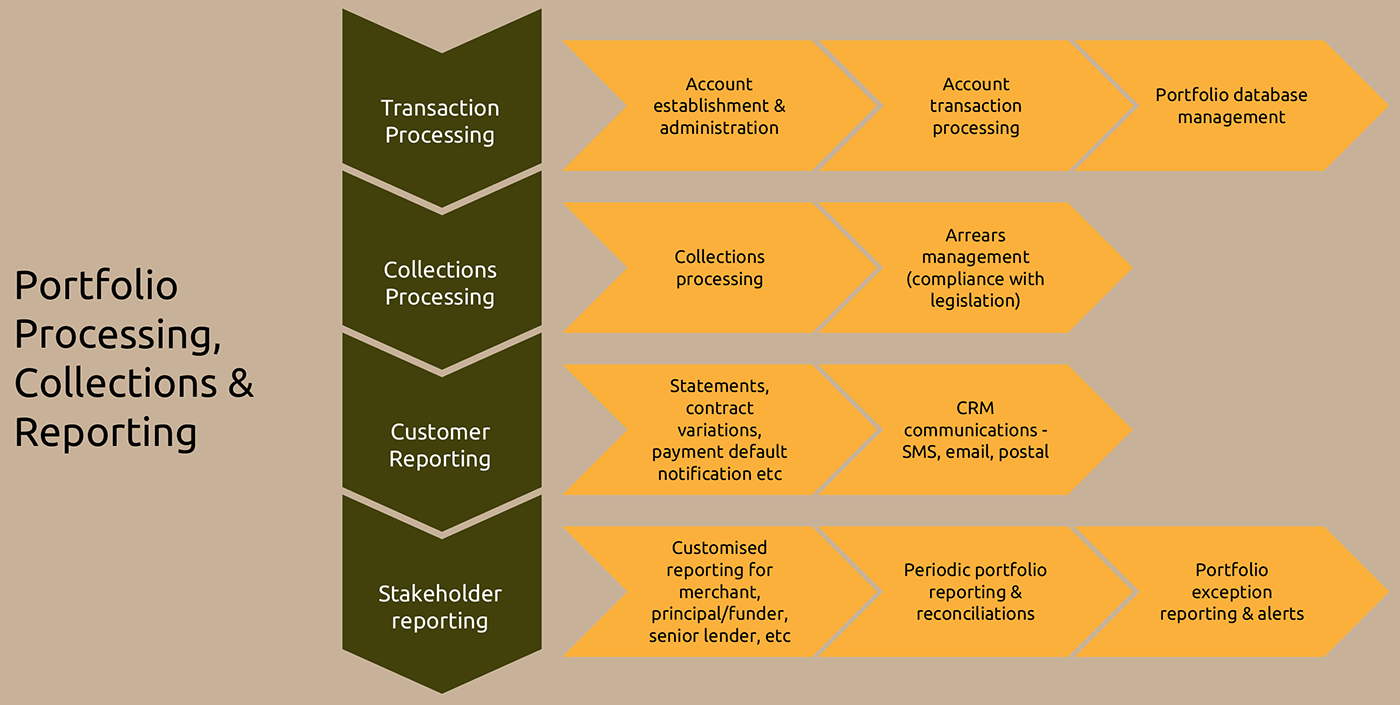

To improve your cashflow via automated collection services - including Direct Debit, BPAY, POSTPAY and Credit Card processing – ACS offers a wide range of outsourced consulting, design, management, processing and IT services.ACS’s solutions can be deployed for a broad variety receivables in addition to traditional credit products – such as membership subscriptions, professional fees, customer contracted subscriptions, customer invoice instalments, professional fees, charitable donations, school fees etc.Engaging ACS’s solutions can be a highly cost-effective strategy that can dramatically improve your organisation’s cashflow.

Talk to us about our suite of advanced end-to-end lending systems

Governance and risk is one of the most important considerations when choosing to outsource the servicing of your portfolio.

ACS constantly strives to maintain the highest standards of service and support to all our clients and their customers.

ACS’s internal controls and procedures are applied across all aspects of ACS and the services we provide including;

In addition, our systems incorporate automated system checks and alerts that identify potential issues – even before they occur.